All Categories

Featured

Table of Contents

The approach has its very own benefits, yet it additionally has concerns with high costs, intricacy, and extra, resulting in it being considered as a rip-off by some. Infinite banking is not the very best plan if you require just the financial investment part. The infinite financial idea focuses on using whole life insurance policy plans as a monetary tool.

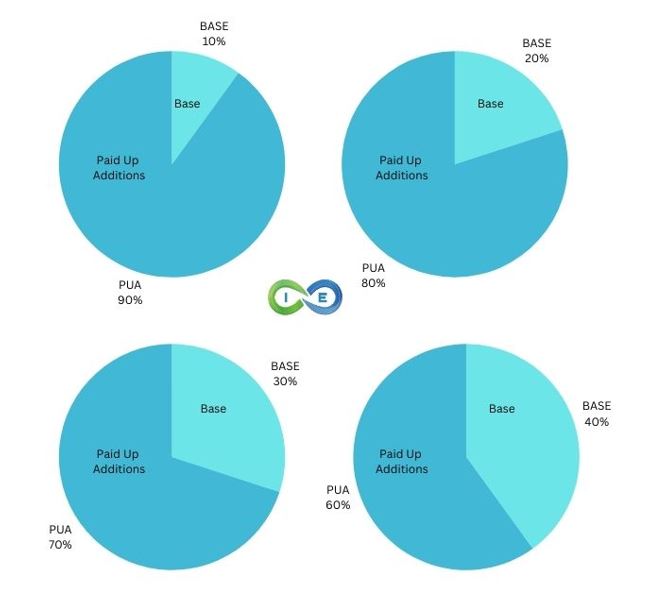

A PUAR allows you to "overfund" your insurance coverage policy right as much as line of it coming to be a Modified Endowment Contract (MEC). When you make use of a PUAR, you rapidly enhance your cash money value (and your survivor benefit), thus enhancing the power of your "financial institution". Additionally, the more cash money worth you have, the better your rate of interest and returns repayments from your insurer will certainly be.

With the rise of TikTok as an information-sharing system, economic guidance and methods have actually found an unique way of spreading. One such technique that has been making the rounds is the boundless banking principle, or IBC for brief, gathering recommendations from celebs like rapper Waka Flocka Flame - Infinite Banking. While the technique is currently prominent, its origins trace back to the 1980s when financial expert Nelson Nash introduced it to the globe.

Is Infinite Banking Account Setup a better option than saving accounts?

Within these policies, the cash money worth grows based on a price established by the insurance firm. Once a significant cash worth accumulates, insurance policy holders can obtain a cash worth funding. These financings vary from standard ones, with life insurance policy acting as collateral, indicating one can lose their coverage if borrowing exceedingly without sufficient money value to sustain the insurance coverage expenses.

And while the attraction of these policies appears, there are natural constraints and dangers, demanding persistent money worth monitoring. The method's legitimacy isn't black and white. For high-net-worth people or business proprietors, especially those using techniques like company-owned life insurance coverage (COLI), the benefits of tax breaks and compound development could be appealing.

The allure of limitless banking doesn't negate its difficulties: Price: The foundational demand, an irreversible life insurance plan, is costlier than its term counterparts. Qualification: Not everyone gets approved for entire life insurance coverage as a result of strenuous underwriting processes that can omit those with specific health and wellness or way of living problems. Intricacy and risk: The intricate nature of IBC, coupled with its dangers, may deter numerous, specifically when simpler and less dangerous choices are readily available.

What is Financial Leverage With Infinite Banking?

Alloting around 10% of your monthly income to the plan is just not practical for most people. Part of what you review below is just a reiteration of what has actually currently been said over.

Prior to you obtain on your own right into a scenario you're not prepared for, know the complying with initially: Although the principle is generally offered as such, you're not in fact taking a finance from on your own. If that were the situation, you wouldn't have to repay it. Rather, you're borrowing from the insurance provider and have to settle it with passion.

Through Infinite Banking, business owners maintain full liquidity. the truth about infinite banking.

With Infinite Banking, business owners control their own financing, ensuring predictable funding for future needs.

Insurance brokers can help structure the right Infinite Banking policy. Discover how to integrate Infinite Banking into your business to build long-term wealth.

Some social media posts suggest using money value from entire life insurance to pay down debt card debt. When you pay back the financing, a portion of that interest goes to the insurance policy business.

Financial Leverage With Infinite Banking

For the very first several years, you'll be paying off the commission. This makes it extremely difficult for your plan to accumulate value throughout this time. Unless you can pay for to pay a couple of to a number of hundred bucks for the next years or more, IBC will not work for you.

If you call for life insurance, right here are some useful tips to take into consideration: Think about term life insurance coverage. Make certain to shop about for the ideal rate.

Can anyone benefit from Leverage Life Insurance?

Imagine never ever needing to fret about bank finances or high interest prices once again. Suppose you could borrow money on your terms and build riches simultaneously? That's the power of unlimited financial life insurance policy. By leveraging the cash money value of entire life insurance policy IUL policies, you can expand your riches and borrow money without depending on traditional banks.

There's no collection car loan term, and you have the liberty to choose the settlement schedule, which can be as leisurely as paying off the funding at the time of death. This adaptability encompasses the servicing of the fundings, where you can go with interest-only payments, maintaining the car loan equilibrium flat and convenient.

How flexible is Infinite Banking Retirement Strategy compared to traditional banking?

Holding cash in an IUL taken care of account being credited interest can usually be much better than holding the cash on down payment at a bank.: You have actually always dreamed of opening your very own pastry shop. You can borrow from your IUL policy to cover the preliminary expenses of renting out a room, buying equipment, and employing team.

Individual financings can be acquired from conventional financial institutions and credit history unions. Obtaining cash on a credit score card is normally extremely costly with annual percentage prices of interest (APR) typically getting to 20% to 30% or even more a year.

Latest Posts

How To Become Your Own Bank

How To Start A Bank: Complete Guide To Launch (2025)

Start Your Own Bank, Diy Bank Establishment