All Categories

Featured

Table of Contents

[/image][=video]

[/video]

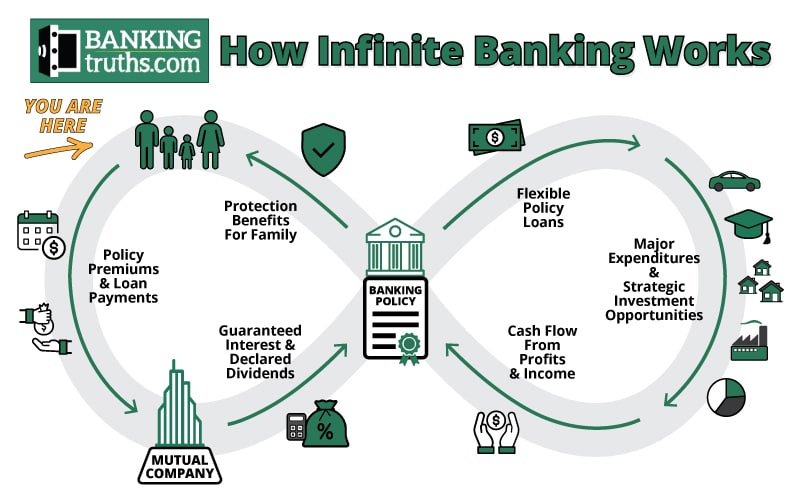

Overfunding your plan is just another way of saying the goal ought to be to take full advantage of cash and reduce fees. If you pick a common insurance policy business, the cash money will have a guaranteed rate of return, yet the assured price will certainly not be enough to both sustain the long-term coverage for life AND create a constant plan finance.

This does not mean the method can not work. It just implies it will not be guaranteed to function. Guarantees are expensive, threat is complimentary. You life insurance cash development in a mutual life insurance coverage firm will certainly be stated each year, goes through transform, and has averaged in between 3.5-5.5% after fees.

Any type of appropriately designed plan will consist of the usage of paid up enhancements and may likewise blend in some non commissionable insurance coverage to even more lower thew charges. We will certainly speak much more concerning PUA riders later on, yet recognize that a thorough discussion in this medium is difficult. To dive deeper on PUA bikers and other methods to lower fees will certainly call for an in-depth face to face discussion.

Currently what? You're about to unlock the power of leveraging equity from this individual financial institution. Your initial step? Obtain versus your cash money abandonment worth. This resembles taking advantage of a gold mine that's been sitting right under your nose. The charm here lies in the flexibility it supplies you can make major and rate of interest repayments on any timetable preferred or pay nothing till able to make a balloon settlement.

Bank On Yourself Complaints

Having the capacity to manage when and exactly how one pays back a finance is important, allowing better adaptability than conventional loans supply. Whole life insurance policy plans, unlike traditional car loans, permit for extremely adaptable repayment routines. The objective here is not just to leverage yet also manage this asset successfully while enjoying its benefits.

Unlike term policies that offer insurance coverage just for collection periods, cash-value policies are right here to stay. One of the most considerable benefits of a cash-value policy is the tax-free development within permanent policies.

By leveraging PUA riders successfully, you can not only raise your plan's money worth yet likewise its future dividend possibility. If you're interested in adding PUAs to your policy, simply get to out to us.

The premiums aren't exactly pocket change, and there are prospective liquidity risks involved with this strategy. I'll just go ahead and excuse half the space now.

Non Direct Recognition Insurance Companies

This has to do with establishing realistic monetary goals and making informed choices based upon those objectives. If done right, you could develop an alternative financial system utilizing whole life insurance policy plans from shared insurance providers offering lifelong insurance coverage at low-interest rates compared to typical lenders. Now that's something worth considering. Overfund your Whole Life Insurance policy to enhance cash worth and rewards, after that borrow versus the Cash Give Up Value.

Enables policyholders to buy sub-accounts, similar to mutual funds. Standard investments that provide potential for development and revenue. Can offer rental earnings and gratitude in worth. 401(k)s, Individual retirement accounts, and other retired life accounts supply tax obligation benefits and lasting development possibility. High-income income earners can become their own bank and produce substantial money flow with irreversible life insurance policy and the infinite financial strategy.

For more details on the infinite financial approach, start a discussion with us right here:.

Ibc Life Insurance

If you do what every person else is doing, you will probably end up in the very same location as everybody else. Dare to be different. Attempt to become extraordinary. Allow me reveal you how. If you are having a hard time financially, or are bothered with just how you might retire at some point, I assume you might discover a few of my over 100 FREE practical.

If you need a that you can truly sink your teeth right into and you are willing to stretch your comfort zone, you have actually come to the appropriate place. It's YOUR cash.

Infinite Banking With Iul: A Step-by-step Guide ...

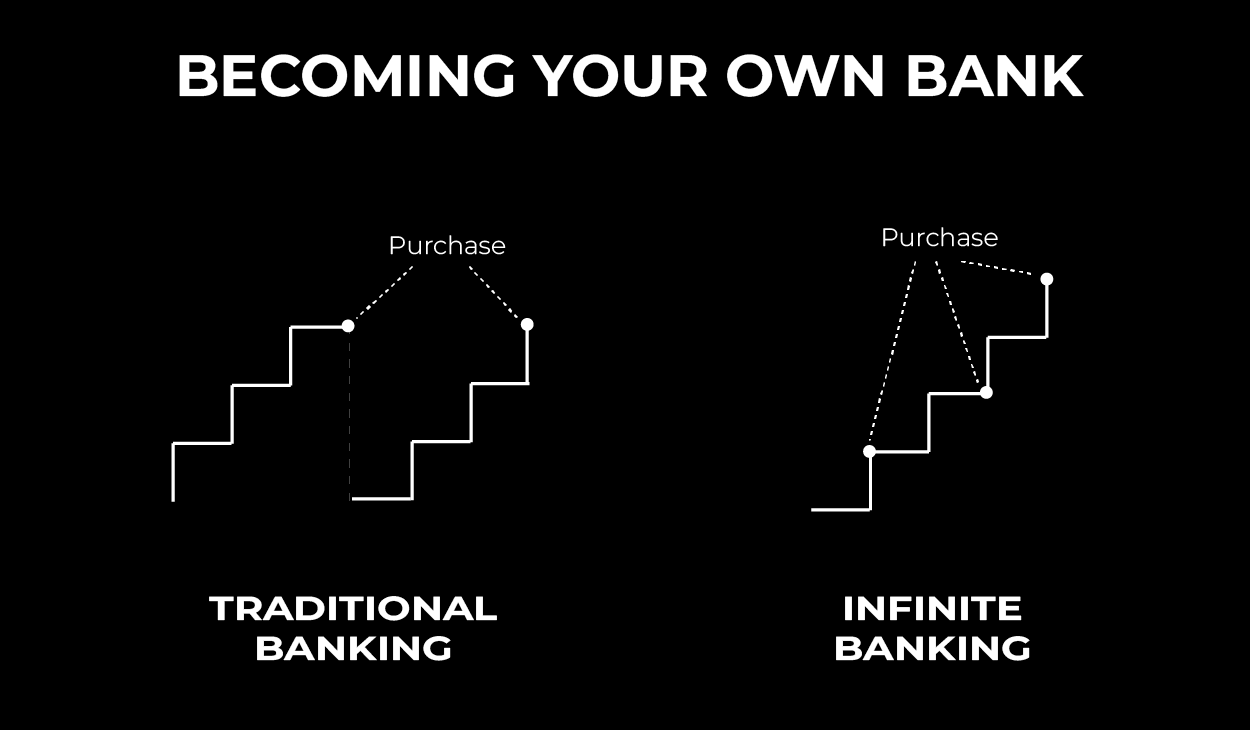

Sadly, that loan against their life insurance coverage at a greater passion price is going to set you back more cash than if they hadn't transferred the financial debt at all. If you wish to utilize the approach of becoming your own lender to expand your riches, it is essential to recognize just how the strategy truly works prior to borrowing from your life insurance policy policy.

And incidentally, whenever you obtain money always ensure that you can make even more money than what you have to spend for the finance, and if you ca n'tdon't borrow the money. Making sure you can make more money than what you have obtained is called producing free capital.

Cost-free capital is even more important to producing wide range than acquiring all the life insurance policy in the world. If you have concerns concerning the credibility of that declaration, research study Jeff Bezos, the founder of Amazon, and learn why he believes so strongly in complimentary capital. That being said, never ever before ignore the power of owning and leveraging high cash money value life insurance to become your own lender.

Discover The Perpetual Riches Code, a very easy system to maximize the control of your cost savings and lessen penalties so you can maintain even more of the cash you make and develop wide range each year WITHOUT riding the marketplace roller-coaster. Download right here > Instance: "I think it's the most intelligent way to collaborate with money.

Lots of individuals are losing cash with common financial planning. Also people that were "set for life" are running out of cash in retirement.

Be Your Own Bank: 3 Secrets Every Saver Needs

Tom McFie is the founder of McFie Insurance which aids people keep even more of the cash they make, so they can have economic assurance. His most recent book,, can be purchased below. .

Individual A-saver ($10,000 each year) and afterwards spender for points we need. Your Savings Account Balance at a financial institution (you do not own) is $10,000. They are paying you 0.5% passion each year which earns $50 annually. And is taxed at 28%, leaving you with $36.00 You decide to take a lending for a brand-new used automobile, instead of paying cash money, you take a finance from the bank: The loan is for $10,000 at 8% rate of interest paid back in one year.

at the end of the year the passion cost you $438.61 with a repayment of 869.88 for one year. The Bank's Profit: the distinction between the 438.61 and the $36.00 they paid you is $402.61. In other words, they are making 11 times or 1100% from you all while never having any of their cash while doing so.

Like come to be the owner of the tool the bank. Allow's keep in mind that they don't have actually any kind of money spent in this formula. They just lent your money back to you at a higher rate.

Self Banking Concept

If you obtain you pay interest, if you pay cash money you are surrendering passion you can have made. In either case you are providing up interest or the prospective to obtain interestUnless you possess the banking feature in your life. Then you reach keep the car, and the principle and rate of interest.

Envision never having to fret about bank lendings or high interest prices once more. What if you could borrow money on your terms and develop riches concurrently?

Latest Posts

How To Become Your Own Bank

How To Start A Bank: Complete Guide To Launch (2025)

Start Your Own Bank, Diy Bank Establishment