All Categories

Featured

Table of Contents

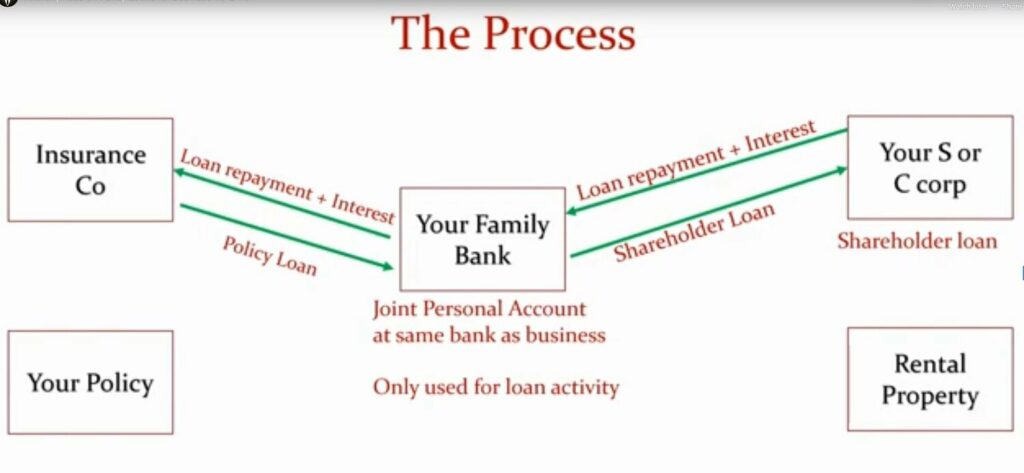

The technique has its very own benefits, but it likewise has issues with high fees, complexity, and extra, causing it being considered as a rip-off by some. Limitless financial is not the most effective plan if you require only the financial investment part. The infinite banking idea revolves around making use of entire life insurance policies as a monetary device.

A PUAR enables you to "overfund" your insurance plan right up to line of it ending up being a Modified Endowment Contract (MEC). When you make use of a PUAR, you swiftly enhance your money worth (and your survivor benefit), thus boosting the power of your "bank". Better, the more cash money value you have, the higher your passion and reward repayments from your insurer will be.

With the rise of TikTok as an information-sharing platform, monetary advice and techniques have actually found an unique means of dispersing. One such technique that has actually been making the rounds is the unlimited financial idea, or IBC for brief, garnering endorsements from celebs like rap artist Waka Flocka Flame - Financial independence through Infinite Banking. While the approach is currently prominent, its origins trace back to the 1980s when economist Nelson Nash introduced it to the globe.

What type of insurance policies work best with Infinite Banking Retirement Strategy?

Within these policies, the cash value expands based upon a price set by the insurer. As soon as a considerable cash worth collects, policyholders can get a cash money worth loan. These lendings differ from traditional ones, with life insurance policy working as collateral, indicating one could shed their protection if borrowing excessively without ample cash worth to support the insurance prices.

And while the allure of these policies is apparent, there are inherent restrictions and risks, requiring persistent cash value surveillance. The technique's authenticity isn't black and white. For high-net-worth individuals or local business owner, specifically those making use of strategies like company-owned life insurance policy (COLI), the advantages of tax breaks and substance growth could be appealing.

The allure of boundless banking does not negate its difficulties: Price: The foundational demand, an irreversible life insurance policy policy, is costlier than its term equivalents. Eligibility: Not every person gets approved for whole life insurance policy due to rigorous underwriting procedures that can omit those with specific health and wellness or way of life problems. Complexity and threat: The elaborate nature of IBC, coupled with its dangers, might deter several, especially when less complex and much less dangerous options are offered.

Can I access my money easily with Bank On Yourself?

Assigning around 10% of your month-to-month income to the plan is simply not feasible for many individuals. Part of what you check out below is simply a reiteration of what has currently been claimed over.

Before you get on your own into a circumstance you're not prepared for, recognize the adhering to initially: Although the principle is frequently marketed as such, you're not actually taking a finance from on your own. If that were the instance, you would not have to settle it. Instead, you're obtaining from the insurance provider and need to repay it with passion.

Some social media blog posts recommend utilizing money value from entire life insurance policy to pay down bank card debt. The concept is that when you pay off the financing with interest, the amount will be sent back to your investments. Sadly, that's not just how it works. When you pay back the financing, a part of that interest goes to the insurance provider.

How do I leverage Financial Independence Through Infinite Banking to grow my wealth?

For the initial several years, you'll be settling the commission. This makes it extremely challenging for your policy to accumulate worth throughout this time. Entire life insurance policy costs 5 to 15 times more than term insurance. The majority of individuals merely can not manage it. So, unless you can pay for to pay a couple of to several hundred bucks for the next years or more, IBC won't benefit you.

If you require life insurance policy, here are some beneficial tips to take into consideration: Think about term life insurance. Make certain to go shopping about for the best rate.

How do I qualify for Infinite Banking Account Setup?

Imagine never having to stress over financial institution finances or high rate of interest once more. Suppose you could obtain money on your terms and develop wealth simultaneously? That's the power of boundless financial life insurance policy. By leveraging the money value of entire life insurance coverage IUL policies, you can grow your wide range and obtain cash without depending on conventional financial institutions.

There's no set finance term, and you have the flexibility to decide on the repayment routine, which can be as leisurely as repaying the finance at the time of death. This versatility encompasses the maintenance of the lendings, where you can go with interest-only settlements, keeping the lending balance level and manageable.

What is the long-term impact of Infinite Banking For Retirement on my financial plan?

Holding money in an IUL taken care of account being credited passion can often be much better than holding the cash money on down payment at a bank.: You've always desired for opening your very own pastry shop. You can obtain from your IUL plan to cover the first costs of leasing an area, purchasing equipment, and hiring team.

Personal fundings can be obtained from conventional financial institutions and cooperative credit union. Right here are some bottom lines to consider. Credit history cards can provide an adaptable means to borrow cash for very short-term periods. Borrowing money on a credit card is normally extremely expensive with annual percent prices of passion (APR) commonly getting to 20% to 30% or even more a year.

Infinite Banking is a powerful way to take control of your finances that allows individuals to build long-term wealth through strategic leveraging.

Insurance brokers specialize in helping clients choose the right policy for Infinite Banking. Unlike traditional financing methods, Infinite Banking provides financial independence, allowing policyholders to become their own bankers. Schedule a consultation with a broker to explore how Infinite Banking can work for you.

Latest Posts

How To Become Your Own Bank

How To Start A Bank: Complete Guide To Launch (2025)

Start Your Own Bank, Diy Bank Establishment